Dental Practice Financials: Benchmarks, Overhead, and Profit Insights [2025 Update]

This post was originally published on August 27, 2015, and updated on November 10, 2025.

Running a dental practice profitably in 2025 takes more than clinical skill. It requires clear benchmarks, strong financial discipline, and smart technology choices. The insights below reflect the latest industry data and what is working for top-performing practices today.

Key Takeaways

-

Dentist production averages $475–$575 per hour, with high performers exceeding $700; hygiene production now runs $145–$175/hour.

-

Overhead sits between 61–67% for most practices, though efficient operations and automation can reduce that to the mid-50s.

-

Treatment acceptance averages 60–80%, depending on patient type and case complexity.

-

Top financial pressures for 2025: rising supply and labor costs, slower insurance reimbursements, and staff shortages in hygiene and admin roles.

-

Wages now represent 25–30% of collections, reflecting inflation and higher competition for qualified staff.

-

Technology adoption—especially cloud-based management systems and automation—remains a key factor in controlling overhead and boosting profitability.

-

Patient attrition averages 12–15% per year, making consistent marketing and recall systems critical for steady growth.

When managing dental practice finances, there are many moving parts. There are income, overhead costs, fees, taxes, insurance reimbursements, and more. Even if you’re the best dentist in town, if you don’t manage your money right, you won’t be able to build and maintain a profitable, financially sustainable practice while still providing top-quality patient care.

I work with many dental practice owners, helping them boost their profitability by increasing their online presence. For this post, we contacted several dentists to gather their feedback on best practices for financial planning in dental practices. Based on our experience working with numerous dentists, we’ll explore the nine essential steps dentists must take to optimize their practice’s financial health and achieve their financial goals.

Listen to this blog post:

BONUS DOWNLOAD: 5 Ways to Market Dental Implants Like a Pro! Grab our free guide and learn exactly how to get in front of your target implant market with our free guide.

1. Hire an Expert to Help You

One of the main actions dentists recommend for managing a practice’s finances is hiring a financial expert, preferably one with specific dental practice expertise. Most dentists are not financial experts and can’t be expected to know how to manage their money efficiently. Hiring an expert, such as a certified public accountant is especially important for dentists come tax time.

Here’s what a few seasoned dentists told us about hiring an expert.

Hire an expert. Use them a lot or a little, but get professional advice. Too many dentists think that because they’re smart in one area, they’re also an expert in finances. Set short-term, medium-term, and long-term goals and stick to them.

You should find a consultant who can sit down with you and make certain that you aren't losing money due to poor management. Most dentists are not great managers of money, but that's why you hire people who are. What affects your profitability the most is that the dentist operates without a full knowledge of where their dollars are going. Working harder won't solve the problem until you diagnose what the problem(s) really is (are).

One word of warning here is that the financial expert you hire should not be your buddy, as this can compromise the quality of their advice (and your financial success.) One dentist told us, “It took me way too long to realize that I didn't really have a financial adviser; all I had were ‘friends’ selling me insurance.”

2. Use Dental Accounting Software

Even if you have an accountant to advise you on financial matters, you still need to give them the hard data they need to assess your practice’s finances. Using the right software, you can easily track expenses, revenues, and other financial information to give your accountant an accurate view of your income and expenses.

Using software like QuickBooks, Xero, or cloud-based dental practice management software such as Dentrix Ascend, CareStack, or Cloud 9, which integrate analytics and AI forecasting, helps streamline financial tracking and reduce overhead.

3. Track Your Important Practice Metrics

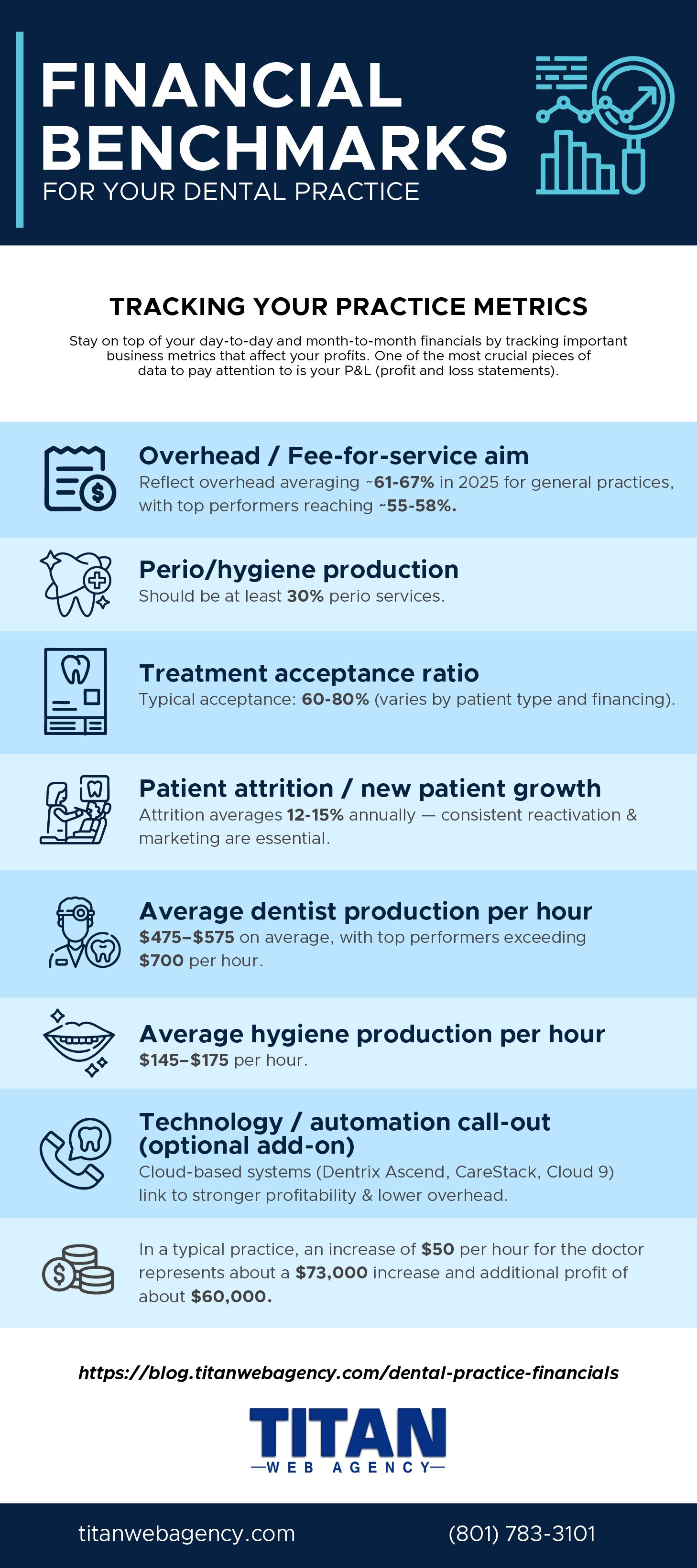

Track important business metrics that affect your profits to stay on top of your day-to-day and month-to-month financials. One of the most crucial pieces of data to pay attention to is your P&L (profit and loss) statement.

The trick is to get to a certain amount of production so that key factors fall within certain percentages every month on your P&L. Wages for staff should be around 25-30%, labs 4-6%, supplies 5-8%, etc. Getting an accurate monthly P&L and studying it carefully is ESSENTIAL. It's hard to get an accurate one unless you are fastidious in maintaining your records.

Some of the other smaller data pieces that affect your P&L (and which you should also pay attention to) are as follows:

- Fixed expenses: Overhead costs that do not change monthly (utility bills, rent/mortgage, loan payments, etc.)

- Variable expenses: Expenses that may change based on your monthly production (lab bills, supply bills, staff pay, etc.)

- Over-the-counter (OTC) collections

- Ratio of period production vs. overall hygiene production

- Doctor and hygiene production per hour

- Unscheduled time units

- Accounts receivable

According to Dentistry IQ articles by Theodore C. Schumann, CPA, CFP, and Dayna Johnson (articles linked below), some good benchmarks for these metrics are as follows:

- OTC collections should be 45% to 55% for fee-for-service practices.

- Perio/hygiene production should be at least 30% perio services.

- Average patient attrition now runs 12–15% annually, requiring consistent marketing and recall efforts to maintain growth. Patient retention must be a focus.

- Average dentist production per hour is between $475-$575 per hour, with top providers exceeding $700 per hour.

- The average hygiene production per hour is about $145-$175 per hour.

- In a typical practice, an increase of $50 per hour for the doctor represents about a $73,000 increase and an additional profit of about $60,000.

Read 10 daily practice statistics every dentist should review, and The 5 stats every dental practice should monitor for more information on these important dental financial stats. The Dental Economics article 5 Steps to producing effective practice financial statements (by Charles Blair, DDS, and John McGill, MBA, CPA, JD) is a useful article as well.

4. Payment Plans and Insurance Coverage

Cash flow plays a crucial role in the financial health of dental practices and their long-term success. We’ll break this down into two main areas: billing and insurance.

Patient Billing

Some of your patients may not have dental insurance or limited coverage, which leaves them with a balance after their treatment. When that’s the case, dental practices can and should look at their collection practices and how they can keep the cash flowing.

One helpful approach is to have a system in place for creating individualized payment plans for patients. With a payment plan, it’s easy for patients to pay their balances on time. They’re less likely to be delinquent or to default on payments, which means you’ll have more cash flowing through your practice. While individual patients may require you to tailor a payment plan, establishing a framework for payment plans is beneficial. Consistency will help your staff address patient concerns and collect payments.

On a related note, you’ll also need to manage insurance billing and payments well. Proper billing procedures minimize claim denials and, like payment plans, help keep the revenue flowing.

Insurance Coverage

When you own a dental practice, stuff happens—stuff out of your control. COVID-19, a riot, whatever it may be, these can all impact your practice revenue. It’s important to protect yourself by purchasing insurance coverage.

Here are some insurance types you may need to protect yourself, your employees, and your practice.

- Dental malpractice insurance

- General liability

- Employment practices liability insurance

- Business owner’s insurance

- Business interruption insurance

- Business overhead expense disability

You may not be required to carry business overhead expense disability coverage, for example. Still, it’s a type of insurance that can cover your overhead if you’re unable to work.

5. Keep an Eye on Other Important Numbers

We’ve already mentioned some statistics, but we should also highlight a few others that can help you better understand your practice's revenue and profitability. Here are a few things to consider.

Patient Statistics

Keeping track of patient statistics is a must for every dental practice. Tracking these things will help you understand how your patients impact your practice's finances.

- Number of patients per day

- Appointment cancellation rate

- Number of new patients per month

- Patient retention rate

- Treatment presented vs. treatment accepted ratio: One dentist told us, “Self-confidence, not charisma, looks or personality; but self-confidence leads to acceptance of treatment recommendations.” (Ratios average 60% to 80%)

- Inquiries vs scheduled new patient appointments

These statistics can help you understand how successful your practice is at attracting new patients and retaining existing ones, as well as treatment compliance and cancellations. They can also provide a broad overview of patient satisfaction.

Average Dentist Production Per Month

On a related note, we strongly recommend tracking statistics related to the average monthly production of dentists. For example, how many patients does each hygienist see in a day or a month? How many patients do you and other dentists see?

These numbers indicate your practice capacity and revenue. If you and your hygienists have a lot of idle time, you must step up your marketing efforts to fill those empty blocks in the schedule.

Dental Office Overhead Percentages

Keeping track of your overhead is essential, as this is an area where many dental practices can increase their revenue. Here are the steps to calculate your overhead percentage.

- Get a current Profit & Loss report.

- Cross out any expense accounts related to practice owners and dentists.

- Add any remaining expense categories together.

- Divide the result by your total practice income, then multiply that number by 100 to get the percentage.

The average overhead percentage in the dental industry ranges from 61% to 67%. Top practices are often able to get it to 55% to 58% through automation and efficient staffing.

6. Be Smart About Setting Fees and Salaries

Fees and salaries are crucial factors that affect your dental practice’s revenues. Fees are typically calculated using average fees for the area and based on insurance reimbursement rates for services. Salaries are based largely on the going rate in your area as well.

Dentists gave us the following advice about setting fees and salaries:

Establish your fees by reviewing current UCR (Usual, Customary, and Reasonable) data and comparing it to local market rates. For staffing, begin compensation at the midpoint of the typical range for each position. As employees demonstrate strong performance and reliability, adjust their pay accordingly to reward contribution and encourage retention.

(In regard to going staff salaries based on area) Washington is ridiculously high, and Utah is super low!

Know your target patient population before you set the price. You should know what your patients need, want and are ready to pay for. Don't be shy in asking for more money for high quality work. Don't be unethical [either]. Share a good portion of what you make with your office mates, as they are like your family. They should feel so warm in that office that they don't feel they are serving you but the patients. That will make them more professional.

Regarding setting fees, another dentist warned, “Don’t be the lowest in your area. You don't want to even enter the 'race to the bottom.’”

A dental consultant can help you set appropriate fees for dental services and salaries. You can also use online tools to find UCR fees based on your zip code.

7. Invest in Things That Increase Your Revenue

It's unfortunate, but true! You have to spend money to make money. However, when it comes to running a practice, where should you allocate your resources (and money) to maximize revenue?

Ultimately, according to the dentists we talked to, it came down to spending money to:

1) Make patients happy (increase satisfaction and loyalty)

2) Boost your practice’s visibility, both online and off (increase online presence)

3) Improve your quality of care

Here’s some specific advice dentists have given us in this area.

- Form relationships with repeat patients by offering them discounts on some services. You’ll get more referrals this way.

- Give back to society by participating in community charity events, volunteering, and other similar initiatives. People will notice you and come to your practice as a result.

- Invest in technology, perks, and facility improvements.

- Invest in quality staff: caring, qualified dentists and staff that truly connect to patients and make them feel respected.

- Market your practice online, paying special attention to local SEO (Google Business Profile), so people in your area looking for your services can find you.

- Manage your online reviews by setting up a review system & encouraging patients to leave reviews, and responding to all reviews.

These things will show patients you care and ensure that your staff is satisfied and eager to come to work every day.

8. Modernize with Automation

Automation is on the rise in the dental industry. Increasingly, practice owners are utilizing automation tools to streamline everything from appointment reminders to marketing efforts. Most dental practice management software includes some automation options.

What does automation have to do with revenue? For starters, it can take repetitive tasks off your employees’ hands, leaving them more time to interact with patients and create a welcoming environment. NexHealth’s recent study about the state of dental revealed that staff turnover was the number one concern for dental practices in 2024. While staffing remains a concern, the top financial pressures in 2025 are rising overhead, inflation, and slowdowns in insurance reimbursement, followed closely by hygienist shortages. When you allow your staff to feel they’re doing meaningful work that makes a difference, they’re less likely to leave.

Automation can also provide patients with a more optimal experience. The number one patient complaint was the difficulty of scheduling or rescheduling appointments. Many patients prefer a digital solution, such as online dental appointment scheduling. Automation can help you provide them with an easy, minimally stressful way to manage their appointments.

You can also allow patients to complete their intake forms online and minimize the time they spend in your waiting rooms. All in all, automation can help you utilize your staff’s skills and time, providing patients with a better experience and increasing patient retention while reducing overspending.

9. Minimize Overhead to Save Money

It may seem like a no-brainer, but businesses and individuals often overlook the importance of saving money in our spend-crazy society. You never know when you might need to replace an expensive piece of equipment or deal with a rent hike for your practice. Of course, you will also want to save some of your take-home income for your family.

The smartest way to build lasting financial stability is to start early and make saving a habit from day one. Aim to reserve at least 10% of every paycheck or owner draw, treating it as a non-negotiable expense. Over time, that consistency becomes one of the most valuable financial safeguards for you and your family.

Beyond personal savings, controlling overhead is another powerful way to strengthen your financial position. This part can be tough—operating expenses keep rising while insurance reimbursements often lag behind—but careful cost management is what separates thriving practices from those just getting by.

Top overhead items, at least for me, are payroll, rent, mortgage. In that order. Those are the things that affect profitability most. Although the fastest way to become more profitable is... more revenue, I know some dentists that run very lean offices. Having a lean office is great. Less stress. And you're working to pay yourself instead of the overhead.

Equipment and labor costs are substantial, and without close financial oversight, a dentist can quickly erode profitability. At the same time, insurance reimbursements have failed to keep pace with inflation for years, steadily tightening margins across the industry.

As noted above, your overhead expenses shouldn't exceed 65% of your revenue. Talk to your dental practice consultant about ways to minimize overhead, and consult your CPA about how to save money on your taxes.

Conclusion

Running a profitable dental practice may seem like a complicated topic. Still, as long as you take the right actions, minimizing your costs and maximizing your profits is not too difficult. You'll need to get organized and make informed financial decisions to achieve these goals.

Enlisting the help of experts can get you on the right track and help you maintain excellent records so you know exactly what is going on with your practice’s finances. If you need any help marketing your dental practice, please don’t hesitate to contact us.

All data verified as of November 2025.

Do you need help attracting new dental patients?

Schedule a FREE consultation!

Let's help your dental practice attract more patients with less wasted spend — no pressure, just results...

Tyson Downs is the founder of Titan Web Agency, a company specializing in marketing for dental professionals. With an impressive track record of working with over 100 dental practices, Tyson has a deep understanding of the unique marketing needs within the dental industry.

.png)

.png)